Support Worker insurance is critical! if you’re an independent NDIS or Disability Support Worker, you will need insurance. And with some rigorous coverage, too.

Learn about insurance for Support Workers on Kynd.

Like all insurance, it might feel like an annoying financial drain. But if the time ever comes that you need to make a claim, you’ll be grateful you had coverage in place!

So what should your insurance for Disability Support Workers include?

What are your options? And why do you need it? We'll cover this and more below!

Important – this article offers general advice only. Be sure to do your own research and make a decision that’s guided by your own circumstances!

Do I Need Insurance As A Disability Support Worker?

Yes! As a self-employed Support Worker offering various support services for NDIS Participants, you need insurance to help protect yourself from any unexpected claims, accidents or other scenarios.

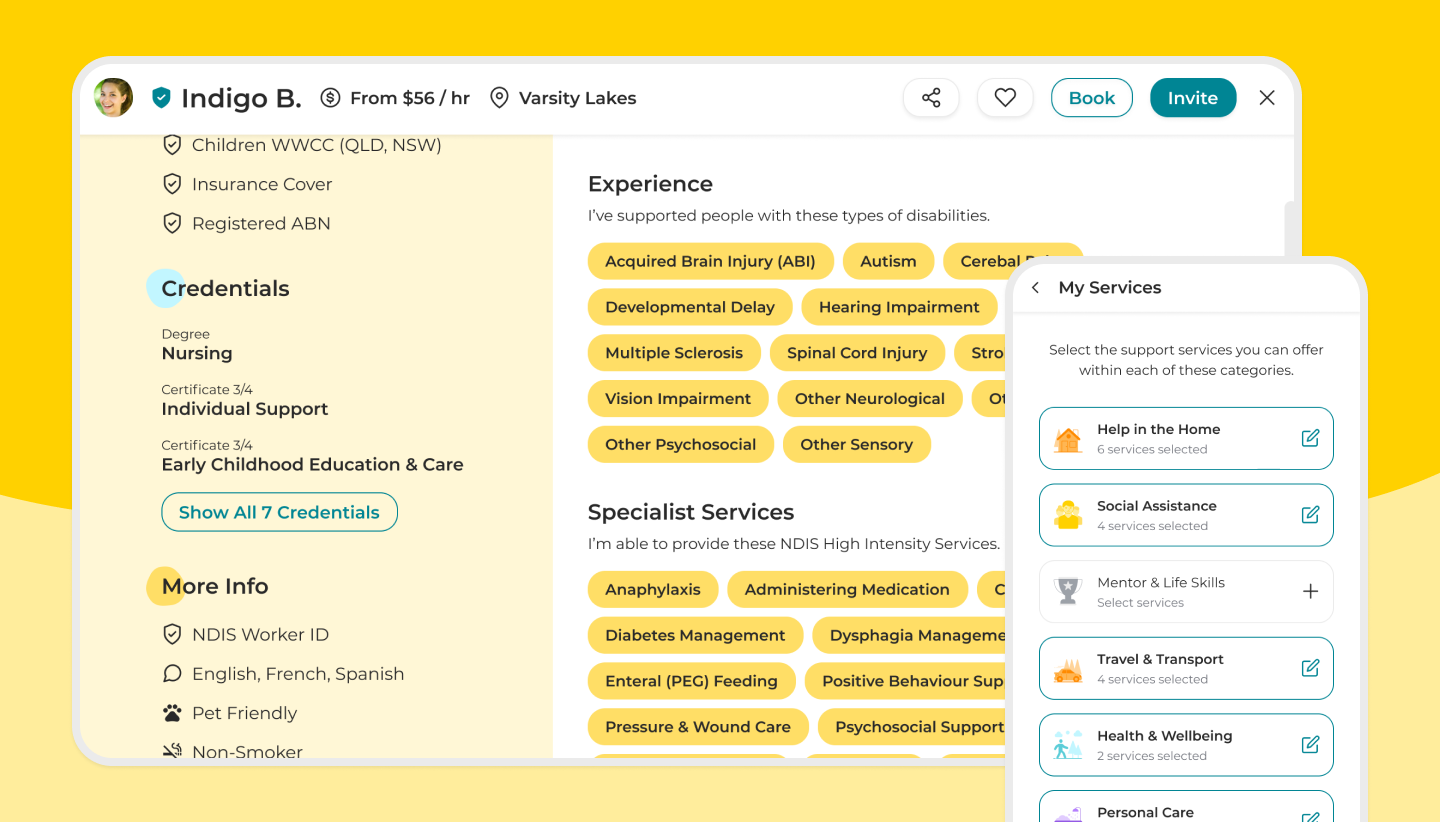

Good news - with Kynd, you benefit from insurance already being available!

Much like driving a car or dashing overseas for a holiday, being a Support Worker carries the possibility of risk, accidents and surprises. That's life, right?

Think of it this way - you can travel overseas, hike a mountain and relax... but what happens if you cause an accident, or your passport is stolen? Be prepared!

You’re offering your services to support another person. You have a duty of care.

With Support Worker insurance, you’ll know that if a problem arises or if you make a mistake, your liability in legal and financial terms has some protections in place.

You might find yourself in an extremely tricky situation if any worst-case unexpected scenarios occur and you didn't have the right insurance coverage.

Disability Support Worker Insurance - What Should It Include?

For independent Support Workers, you need:

- Public Liability Insurance

- Professional Indemnity Insurance

These types of Support Worker insurance help protect you from legal claims.

Other types of policies are optional.

- Personal Accident and Sickness Insurance

- Income Protection Insurance

If you’d like to obtain extra insurance coverage for your specific personal needs, special or excluded activities, travel insurance, personal injury, income protection, or anything else… as a self-employed Support Worker, that’s entirely your choice!

Public Liability Insurance for Support Workers

Public Liability insurance is for anyone who deals with customers or members of the public. Which might make you wonder if a guy serving burgers at Maccas needs coverage, too? The short answer is no! They'd have workers' compensation.

When you have an employer, they cop the burden of the risk for you.

But as an independent or self-employed Support Worker, the onus falls on you.

Don’t think you need Public Liability insurance? Consider this:

You have taken your client to a Devonshire tea at a local town hall. You order a cup of tea and take a seat with your client, leaning their crutches against a wall. A stranger walks past and trips on the crutches, knocking your tea all over themselves on the way to the floor. An honest mistake, but what if you're deemed responsible for any damages or injuries to them.

Professional Indemnity Insurance for Support Workers

Professional Indemnity insurance brings up big topics like negligence and breaches of a professional duty of care including industry guides codes of conduct.

The fact is, being a Support Worker is very important and prone to legal ramifications when things go wrong. PI could protect you—even in the unfortunate instance that you make a mistake or something goes wrong.

Don't think you need Professional Indemnity insurance? Consider this:

Your client needs hourly medication so you have an alarm set on your phone to remind you. On the way home from an outing your phone slips out of your bag onto the floor of your car. You return inside and don’t hear the alarm going off, missing the required medication, which causes your client to have a sudden medical episode. Though it was an innocent error, it’s possible you could be deemed negligent and financially responsible.

Options for Support Worker Insurance

Now it’s time to weigh up your Support Worker insurance options.

A great option is finding Public Liability insurance and Professional Indemnity insurance conveniently grouped together, much like the insurance Kynd offers to Support Workers, with coverage for bookings arranged within the platform.

Alternatively, you can seek out the various components of insurance you want and need independently. For anything more custom, you'll likely need a broker.

Cheap Internet Insurance Policies

You get what you pay for right?

Sometimes in social media forums or via word of mouth, Disability Support Workers may recommend websites that offer very cheap insurance coverage. It's important to always read the policy inclusions, exclusions, excesses and cover.

Policies exist that are marketed for independent Support Workers, but they actually exclude many (or most) of the normal support activities you might offer.

So beware! Check the nitty gritty.

Additional Insurance

Personal accident insurance isn’t compulsory as a self-employed contractor, but many disability Support Workers take it out for added protection. You can even explore if this type of insurance is available in your superannuation fund.

Other policies can be applied for by an insurer of your choice, as they aren’t typically covered in a Support Worker insurance policy.

Tip - No matter how you acquire your insurance, be sure to read the fine print with a magnifying glass. Ensure the policy actually covers you!

What Other Insurance Policies Can I Get?

Life insurance, total and permanent disability (TPD), car insurance and personal accident insurance are also some common insurance policies for Support Workers.

Tip - Before you take out TPD or life insurance, check that they are not already covered by your superannuation fund. Don't double-pay for things.

You may also wish to consider any specialised activities you are partaking in. For example, if you need to take an overseas trip as a Disability Support Worker, you should take out coverage in the form of Travel Insurance if it isn’t covered by your other policies. Offering horse therapy? You'll likely need a special policy in place!

Remember that some activities might be covered by the insurance of a third party.

For example, if you find yourself supporting your client to go skydiving or snorkelling, these might be covered directly by the experience provider.

What Do I Need To Be Eligible For Disability Support Worker Insurance?

The eligibility requirements of Disability Support Worker insurance depend on which company you've chosen to take out your coverage with.

Some insurers may require proof you are qualified to offer services in the industry. Other companies may just request a few easy details to be completed in a form.

Once you’re covered, you may find this insurance enables you to do other things that are unrelated to your work as a Disability Support Worker.

For example, maybe you’ll host a stall at your local markets or do some odd jobs for your neighbours without risk or concern. Oftentimes your insurance will offer protection for more than just your services offered or work in the disability sector.

What Do I Need To Look Out For?

There are heartbreaking stories rolling around the NDIS community about sneaky fine print and ambiguous insurance descriptions. Be sure to do your homework about Support Worker insurance and take the time to read every sentence of your policy.

Don't trust every Facebook Group comment.

Once you’ve read the inclusions, take some time to consider what hasn’t been excluded. A specialist policy focused on Disability Support Workers is often the best way to go - but read and ensure you're not just assuming coverage on activities.

With Kynd, you get Support Worker insurance included if using the platform.

Insurance for NDIS Participants?

Remember that Support Worker insurance exists to cover Support Workers.

We encourage NDIS Participants, Members and households to always obtain their own insurance to provide cover in respect of any liability, including damage or loss to property and/or death of or injury to any person or Support Worker at your property, whether or not caused by you, a Support Worker or any third-party.

This may be a home and contents policy with the relevant liability extensions and/or a household workers policy in your state or other insurance policies.