Aaah, tax time: the most wonderful time of the year as you hunt for your Support Worker tax deductions. It's up there with Christmas and Easter. (Okay, maybe not.)

Unless you’re an ATO guru, tax season is not always a fun time—in fact, it can be pretty stressful, but as a self-employed Support Worker, it only takes a bit of early organisation and it doesn't have to be! So how do you figure out what’s what?

Important - this is general advice only. Always research your own situation.

You probably already know this, but just here’s a quick refresher just in case: tax deductions as a Support Worker help reduce your overall taxable income.

You can deduct anything you’ve purchased for work purposes and to help you generate your income. Deductions help decrease your taxable income.

So what Support Worker tax deductions can you claim?

What can’t you claim? We’ve drawn up this handy guide to help you learn which tax deductions you can typically claim as a Support Worker - and which you can't.

Okay, Give Me The Lowdown On Tax Deductions

The first rule about tax deductions is you can’t claim stuff you were already reimbursed for. For example, if you purchased art supplies to prepare an activity with your client, you can’t claim the supplies as a deduction if your client has already reimbursed you for the supplies. That's double-dipping and a big no-no.

The second rule is you need to be able to prove the expense for it to be a Support Worker tax deduction, so keep all receipts or invoices. The ATO has a free myDeductions app to keep track of all your expenses. It’s a good idea to do it regularly so you’re not left with a giant pile of receipts to deal with on 1 July!

The third rule is you can only claim the work-related part of your expense. Going back to our art store example, if some of the paintbrushes you buy are used in your personal time, you can’t claim that portion as a deduction.

You can also check out our guide:

How to manage your tax as an independent Support Worker

What Can I Claim As A Support Worker?

Quite a bit actually! As a Support Worker, can typically claim deductions under:

Self-Education

If you do any first aid or CPR training or undertake further studies, such as a Certificate III in Individual Support, or continued professional development, or any training relevant to being a Support Worker, you can claim the cost of those courses.

You can also claim any work-related books, magazines and journals you might have bought that help you increase your income as a Support Worker. This includes any online subscriptions directly relevant to your line of work and income.

Travel And Vehicle Expenses

But not all travel is created equal. Here’s what you can claim:

- If you drive or take public transport to and from clients’ homes (you can claim each trip!);

- If you drive or take public transport with your clients to take them to an appointment or activity.

Here’s what you can’t claim:

- If you drive from your home to the same work location every day;

Tip: Keep a logbook of all kilometres you drive and receipts for travel.

Consumables

Anything you purchase to directly use in generating an income or your work can typically be a tax deduction. This includes a diary or notebook to keep client notes in, face masks, hand sanitiser and antibacterial wipes you use at work, or sunscreen for you and your client when you are out and about. Anything your client or their carer doesn’t reimburse you for, you could claim at tax time.

Computer, Phone And Internet Costs

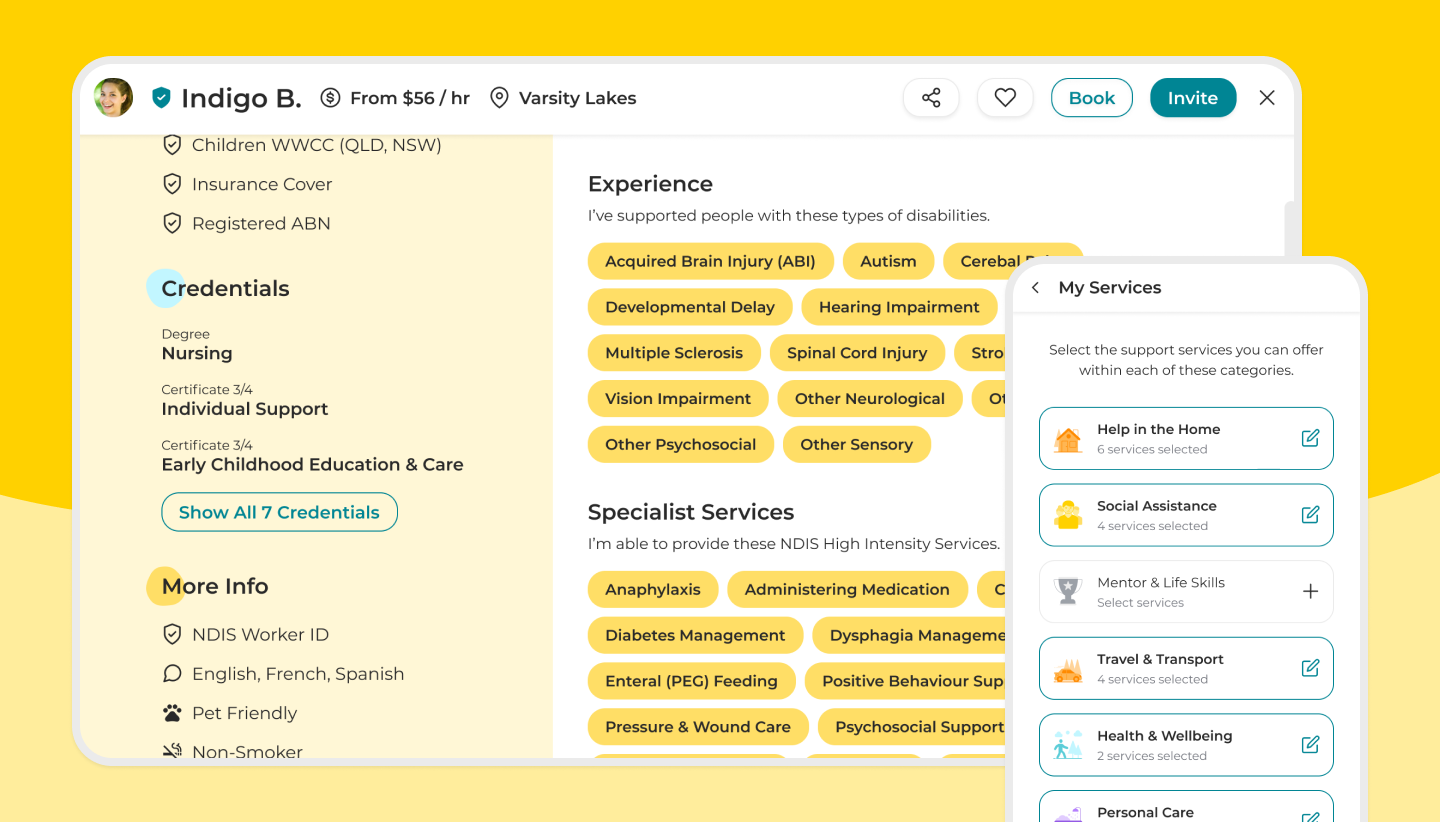

As a Support Worker in this day and age, you’re very likely to use a laptop or your phone for work purposes, such as when you’re logging on to Kynd to check your bookings for example. You may be able to claim a portion of the costs for phone and internet.

You’ll have to estimate what percentage that is. For example, if you use your laptop connected to the internet one hour a day, and you spend 30 minutes on Facebook for your personal use and 30 minutes managing next week’s schedule on Kynd and looking for new activities to do with one of your clients, you might be able to claim 50 per cent of the cost of your internet connection at tax time.

Similarly, you’ll likely use your phone to make calls for work purposes, so you can claim the related portion of your monthly phone bill and costs as a deduction.

When it comes to the cost of the phone and laptop or computer themselves, if you purchase them solely for work purposes (i.e., you have your own personal phone and buy a new phone for work only), you can claim the cost of that second phone at tax time. But if you use the one phone for personal and work use, you can’t claim.

Working From Home

Being a Support Worker naturally comes with some paperwork. For example, if you are doing admin which you’ll likely be doing from home, this might require electricity or gas for heating or cooling and lighting. The ATO has a handy home office expenses calculator you can use to work out how much you can deduct.

More Support Worker Tax Deductions!

There might be other tax deductions you can consider as a Support Worker.

- If you’ve purchased a fob watch (you can’t claim a conventional watch though);

- The cost of your National Police Check, NDIS Worker Screening Check and Working with Children Checks (any other checks you might need);

- Any donations over $2 you made to registered charities;

- Any premiums for other insurances (unless included in your Super fees);

- The services and expenses of a tax agent or accountant. So if last financial year, you got some help from a tax agent, you can claim their fee the next year.

Even if you’re not huge on paperwork, it pays to get organised and keep all your receipts and logs for anything work-related, as it could make a big difference with your tax return (and who doesn’t love a bit more cash back in the bank?).