As an independent Support Worker you need to manage our own tax and it's actually really simple. Sure, it's not one of the most exciting ways to spend your spare time, but it's important to keep on top of it. You'll quickly become a guru!

With a few simple steps and this helpful tax guide for Support Workers...

You'll quickly be able to set up solid tax management foundations, set up and manage your superannuation choices, and even understand what support worker tax deductions you can claim to help lower your "assessable income".

Important - this is general advice only. Always research your own situation.

FAQs Self-Employed Support Worker Tax

Do I still have to pay taxes?

Yes!

Do I have to pay into my Super?

That's a personal choice. You don't legally have to. Many Support Workers do.

If you contribute to Super… you may also get Government Co-Contributions.

Am I eligible for tax deductions?

Yes! Aussie taxpayers may be able to claim certain tax deductions.

Do I have to be registered for GST and BAS?

Generally no… but if earning over $75k, you need to register your ABN for GST.

If registered for GST, you may need to do regular Business Activity Statements, but importantly, NDIS supports and services are generally exempt from GST.

Do I need to submit a tax return?

Normally, yes! We'll share some simple and faster ways to help you.

Getting Started

The first thing you need to remember with taxes for independent Support Workers is that you're a Sole Trader. This means that you work for yourself.

To set up taxes for Support Workers, here's a few suggested steps.

1. Apply for your ABN

You can apply for an ABN directly on the Australian Business Register.

It can be done online in 5 minutes and it's free! Click here to start >.

Beware of any websites that make you pay to apply for your ABN number.

You might even have an old ABN that's still active - search and look here >

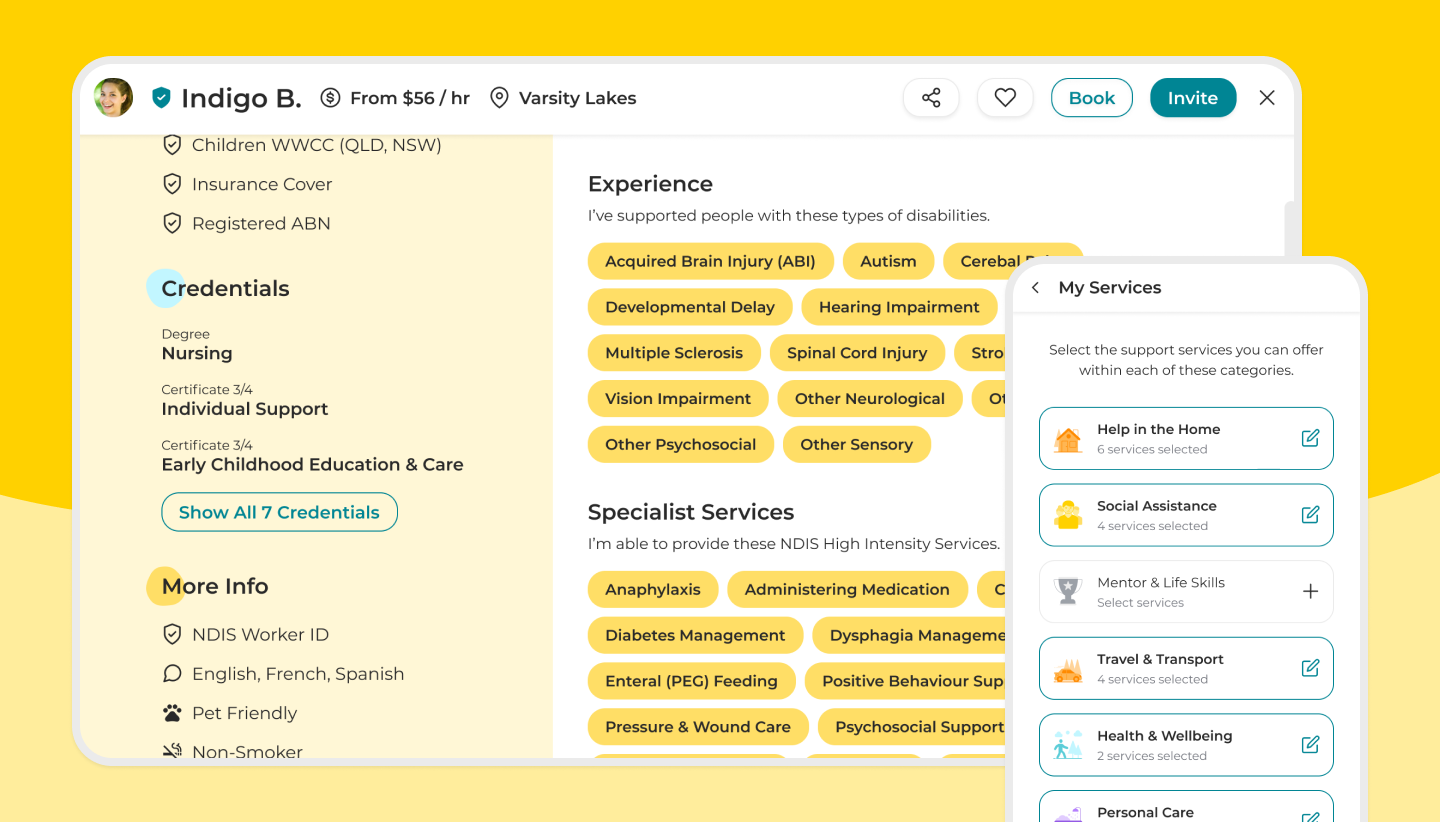

When creating your profile on Kynd, we'll ask for your ABN also.

2. Consider setting up 2 bank accounts

Why you ask? Tax management for Support Workers can be really simple!

Like any small business, you ideally want to separate your personal life and 'business' expenses. You don't want to see all transactions mixed in together. If you do mix transactions, you're creating extra work for yourself at tax time!

We recommend that Support Workers set up a simple account structure…

1 x Trade Account for revenue (money in) and any work expenses (money out)

- This helps you easily understand your earnings and find potential deductions

- At set times, you can transfer funds to your personal accounts for living costs

1 x Taxes Account, to allocate and save a portion of your earnings for taxes

- This helps you build up a reserve to pay your annual taxes - if you owe a bill.

3. Estimate your "Tax Savings Percentage"

If you're starting out as a Support Worker, it might be tricky to predict your earnings. If you've been doing it a while, you might know what your estimated annual earnings are. Worst case - make your best guesstimate of earnings.

Your Tax Savings Percentage is the percentage of your earnings or income to set aside for taxes - and that's a great habit to help avoid tax time bill shock.

A helpful website to estimate your "Tax Savings Percentage" is Pay Calculator.

You can enter an estimated annual earnings (or income) amount and choose lots of options (ie. HECS, kids, etc) as relevant for your personal circumstances.

Let's share a quick example...

- I enter $50,000 for my annual earnings (after deductions)

- It tells me I will need to pay $6,387 in taxes

- This means my Tax Savings Percentage is roughly 12.8%

- Each month, I plan to send 13% from my Trade Account to my Taxes Account

That's just a hypothetical scenario of tax planning for Support Workers.

4. Make a Choice about Superannuation

Good news - with superannuation for self-employed Disability Support Workers, you have a choice about whether or not to contribute to Super. You're not legally required to contribute. If you do, you can decide how much.

Some independent Support Workers prefer not to contribute, as they need or want to use their money now. Maybe you're saving for a house deposit or just needing every dollar right away. Others prefer to always contribute to Super.

Wondering how to choose a superfund for Support Workers? Here's help >

You now have decisions to make...

- Do I want to contribute to my super?

- If Yes, how much do want to contribute?

- If Yes, when do I want to contribute?

Remember, for normal PAYG employees, the minimum super for Support Workers payable by employers is 10% of an employee’s overall earnings. That "minimum super guarantee" will also be increasing over the next few years.

Your retirement is also important, so plan the right strategy for your life.

Super Co-Contributions for Support Workers

You could receive Co-Contributions from the Government.

These Super Co-Contributions are designed to boost retirement savings.

The Australian Government might 'match' the personal super contributions you make. Certain limits exist of course, but it's a way to boost your super.

When to Transfer Contributions to Your Super

If contributing to super, the goal is to watch your investments increase!

So if you wait until the end of the year, you may miss out on some growth.

For example, let's say your chosen super fund achieves a 15% investment return this year (woohoo!). If you wait until almost 25 June to contribute (before the financial year ends), you've already missed 360 days of potential super growth. However, if you choose to contribute quarterly, you'll catch a lot more upside.

It can be better to make regular contributions. Do what's right for you.

5. Get Support Worker Tax Deductions

It's time to plan and track your Support Worker Tax Deductions.

Many Support Workers miss out because they don’t understand what tax deductions they are entitled to claim. If you’re new to this, it’s actually easy!

To claim tax deductions as an independent Support Worker, you first need to be aware of a couple of things:

- You weren’t reimbursed for the deduction you’d like to claim.

- You must have a record of any expenses you want to claim. E.g. receipts or invoices. The ATO’s myDeductions app is a free and easy way to keep track of all your potential Support Worker tax deduction expense records.

- You can only claim the work-related part of your expense. You can’t claim a deduction for an expense that is a personal-related activity.

It's always best to chat with an Accountant and get professional advice.

Learn what Support Worker tax deductions you might be eligible for.

1. Self-Education for Support Workers

If you do any training or courses that are directly related to your work as a disability Support Worker you can claim the costs of the training or course.

These might include:

- Textbooks

- Stationary

- Travel to and from the course

- Internet connection and telephone calls

- Tools and equipment

- Any accommodation that you have to pay to attend a course. For example, if you live in a regional area and had to travel to a major city to complete the course or training, you can claim these travel and accommodation expenses.

- Courses and training examples include CPR and First-Aid, OH&S, Certificate III in Individual Support, Certificate IV in Disability Support, Understanding Mental Health and Working with Physical Disabilities.

2. Car Expenses for Support Workers

Disability Support Workers can claim tax deductions on your car for travel between one place of work to another. For example, if you drive from one client’s house to another, you might claim this fuel and mileage expense.

You can’t claim your drive from home to work, however, you can normally claim the time you’ve helped transport your client to an appointment or activity. You can normally claim both mileage and additional fees such as parking and tolls.

To claim your car expenses, you can either use the logbook method or the ‘cents-per-kilometre’ method.

Logbook method

- Expenses include running costs and decline in value but not capital costs e.g. the cost of buying your car and any improvements costs.

- Your logbook must cover a minimum of 12 consecutive weeks.

- If you use 2 or more cars, you must have a separate log book for each car.

- You must keep the actual receipts of fuel or oil costs and record a mileage estimate based on the odometer records that show before and after you used your car for each claimed session.

Cents per kilometre method

- You can claim a maximum of 5000 kms per car per year.

- To calculate your tax reduction, multiply the number of kilometres your car has travelled in the taxable income year by the appropriate rate per kilometer for that same taxable income year.

- The current ATO rate for 2020 - 2021 income year is 72 cents per kilometer.

- Use the ATO app to easily track your work trips.

You’re not able to add other expenses such as registration fees, maintenance, repairs and fuel costs on top of this claim.

It’s completely up to you how you’d like to record your car expenses.

3. Other Travel Expenses for Support Workers

In addition to car expenses, as a Disability Support Workers you can claim a tax deduction for public transport expenses if they’re related to travelling with a client to an appointment or activity, or between 2 clients homes.

If you go away with your NDIS Participant client for a work-related or holiday trip and have additional expenses which relate to accommodation, food and transport, that were not refunded by the client, you can likely deduct these.

4. Consumables for Support Workers

As long as you are not reimbursed by a client, you can claim stationary, materials and personal protective equipment (PPE) that relate to activities with clients.

Examples include:

- Art equipment

- Sunscreen

- Face masks and hand sanitiser

- Learning equipment such as sensory toys.

5. Laptop, Phone and Internet Costs for Support Workers

Personal Support Workers can claim tax deductions for the cost of purchasing and using a laptop or mobile phone to communicate with clients. If you claim more than $50, you need to keep records to show your business use portion.

With tax deductions for independent Support Workers, as you're running your own small business, you may also have other technology or device deductions.

6. Other Support Worker Tax Deductions to consider:

- The cost of work-related to books, magazines and journals.

- The cost of a fob watch - you can’t claim a conventional watch.

- The cost of National Police Check, NDIS Worker Screening Check and Working with Children Checks (any other checks you might need)

- Any donations you contribute to registered charities.

- Any premiums for income protection insurance (unless paid via Super)

- The services and expenses of a tax agent or accountant.

You're on your way to maximising your eligible tax deductions as an NDIS Support Worker. That helps lower your taxable income, so you save more.

Make a list of the tax deductions that might apply for your situation.

6. Your Support Worker Tax Return

As an independent Support Worker, you're not automatically getting tax withheld on your income and the revenue for your NDIS support services.

To ensure you don’t get surprised with a large tax bill at the end of the financial year, it’s important to put away your Tax Savings Percentage (see tips above).

Tip - Know and save your tax savings percentage in a separate account.

You don't want to accidentally dig into these funds and be left without money to pay any tax bills. If you put away more than required, it's a savings bonus!

Your overall position for the tax year is calculated by looking at your gross income minus any deductible expenses incurred as part of the business.

Complete and submit your annual tax return to determine your income tax liability and bill for the financial year (1 July to 30 June each year). The deadline for submitting your tax return is 'normally' the 31st of October each year.

Your business position is income to you as a sole trader business. It’s included as part of your taxable income when you lodge an annual personal tax return.

Important: The info above is general insight only. It's not personalised or professional advice. Everyone has unique circumstances. Always do your research. Speak with an Accountant and you can visit the ATO website and other websites. Getting the right advice early means less time on admin!

Support Worker Tax Checklist

Here's a summary of tax tips for independent Support Workers:

☐ Always research and consider your own situation

☐ Get your ABN set up for free on the Government's website

☐ Consider setting up 2 bank accounts (inc. 1 for tax savings)

☐ Estimate your tax savings percentage to set aside

☐ Make a choice about superannuation and what you prefer

☐ Get to know and track your Support Worker tax deductions

☐ Like everyone, submit your annual tax return on time

Managing taxes for Support Workers is actually quite easy. This might seem a little confusing at first, but once you're into it, you'll see just how easy it can be!

Feel free to share this guide with your Support Workers and friends!